Economist Michael Roberts says the change of tone within the OECD is interesting, but there are no takers ready to implement estate taxes to reduce inequality

Story Transcript

SHARMINI PERIES: It’s the Real News Network. I’m Sharmini Peries coming to you from Baltimore. The OECD, the Organization for Economic Cooperation and Development, is well known for promoting neoliberal policies, not much different than the International Monetary Fund or the World Bank. This week the OECD published a report titled “The Role and Design of Net Wealth Taxes in the OECD,” which takes an unexpected turn, promoting the use of taxes on capital, and even estate tax, a tax on your inheritance.

Michael Roberts has been working in the City of London for over 30 years and is the author of several books, “The Great Recession” and “The Long Depression.” He joins us from London. Michael, thank you so much for joining us today.

MICHAEL ROBERTS: Hello, Sharmini.

SHARMINI PERIES: On the report, “The Role and Design of Net Wealth Taxes in the OECD,” give me in one minute what the report contains that is useful.

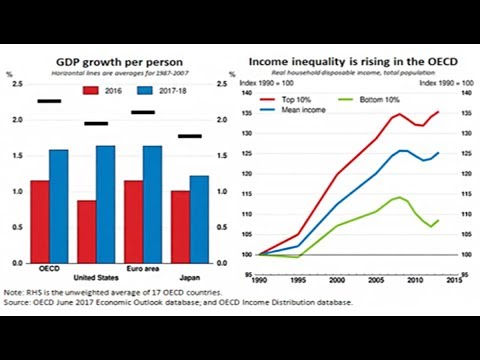

MICHAEL ROBERTS: I think the first thing it says is that, first of all, wealth inequality is much more serious and much more important in many ways than income inequality , because wealth inequality generates more income inequality, and rich people have more power and influence and opportunities, and are able to generate income without work. One of the facts it points out in the report is that someone working for, say, twenty thousand euros a year and gets its money from capital is a much more powerful position than somebody having to work for twenty thousand dollars a year. And working for twenty thousand dollars is hard work. Getting income without doing anything at all is easy, and yet it also gives you much more power.

MICHAEL ROBERTS: So wealth accumulation reinforces the situation. Wealth begets wealth, says the report. And that gets more power. And that means we need to do something about it because this situation will continue to get worse. The rich will get richer and the poor, that’s the rest of us, will get poorer, at least relatively. That’s what the report tells us. It’s a really astounding report.

SHARMINI PERIES: So Michael, last time we spoke back in October, I think, about the IMF’s murmurs about rising inequality in the world. And now we see that the OECD is joining this trend in terms of trying to address this inequality. Why is the OECD very, which is a very neoliberal and anti-taxation kind of organization, adopting language that we have not heard them use before?

MICHAEL ROBERTS: Yes, it’s a very surprising development. As you say, the OECD has a reputation for being neoliberal, as some of us say on the left, which means that they’re interested in preserving the interests of capital and not the interests of labor and generally trying to raise profitability for most economies around the world, for the sections that own the means of production. And this is a bit of a surprising report. And they’re saying that wealth inequality is much more important and much worse than income inequality, and something’s got to be done about it, which is a very big surprise. And I think that’s because they’re concerned the level of inequality in wealth globally, and in most of the big economies, is so, getting so extreme. We haven’t seen these levels probably for 150 years. Then it could lead to a breakup of the social fabric and political protests. And they recognize that something’s got to be done about it.

SHARMINI PERIES: All right. Now, we’ve known about this growing inequality for a very long time. And I suppose the 2013 book by Thomas Piketty may have brought it further into light, the French economist who wrote the book “Capital in the 21st Century.” Now, since then they’ve had an opportunity to address this issue, but not much has happened interim, and now they’re bringing it about. So it raises the question of, you, know, how serious are they? Are they willing to change the laws of the OECD countries, and are they willing to really go out and bat for these policies when it comes to national governments adopting such policies?

MICHAEL ROBERTS: I think there’s little chance of it. I mean, just to give you a few extra facts which are not in the OECD report that the U.N. economists came out with, they found that the top 1 percent of wealth holders in the world, and 51 percent of all the wealth in the world, and the top 10 percent and 85 percent of all the personal wealth in the world, and the richest 1 percent, at the rate that they are increasing their wealth 6 percent a year, will have two thirds of the world’s wealth by 2030. It’s a staggering figure. The level of wealth the top 1 percent is growing at twice the rate of the level of wealth for the rest of us in the world’s population. Of course, the vast majority of the world’s population doesn’t have any wealth at all. It will mean that the top 1 percent would have, can you think of this, $305 trillion, worth of wealth, in forms of financial assets, property, and cash savings. More than double.

Now, that’s a massive increase, and that’s why the OECD is being forced to think about it. But I, I’m, I have no doubt that none of the governments that we look around the world, the major governments are going to do anything about this. We know that the U.S. administration under Donald Trump, far from looking at reducing the wealth of the rich, is adding to the wealth of the rich by cutting corporate taxes and income tax for the rich. In other countries, the mainly center-right governments in Germany, in Sweden, in Britain, in Japan, none of these governments have any program at all for reducing the level of wealth inequality, let alone income inequality, or any program to do so or any intention to do so over the next few years.

SHARMINI PERIES: Robert, what they call the inheritance tax, or the state tax, or what the Republicans in the U.S. call the the death tax, they are not very popular, because of course this means that you can’t, you know, transfer all of your wealth onto the next generation , your children, and then maintain the elite ruling class we have in the in the U.S., and of course beyond, all over the world. How could we attack this? How could the EOCD, if you had the opportunity to advise them, how can it be done?

MICHAEL ROBERTS: Well, there are several things, I think, Sharmini. First of all, is it the best way to tax people who are receiving benefits from when their parents or relatives die? Is that the most important issue, the personal wealth tax, which is the view of Thomas Piketty and others, the economists you talked about. Or is it more important to have real control over the concentration of capital which exists in the big corporations, the big companies, which control our means of production and lead to the generation of this huge income growth and wealth growth to the top 1 percent. Seems to me we should be looking in that area.

The OECD admits that taxing incomes would not actually do much to change the level of wealth inequality. And then Looking at the taxation, maybe, of it inherited wealth, and going further, perhaps, only four countries of the world actually tax wealth. Everybody taxes, governments tax income but they don’t tax wealth. Very few countries. And the number of countries prepared to do that is actually falling, not rising. So it seems to me that looking at personal wealth is only one area. The way we really need to look at what’s going on with corporate wealth and the concentration of capital there.

And one other area, Sharmini, is the huge amount of havens where no wealth is taxed at all. Daniel Zachmann, who is a colleague of Thomas Piketty, did a special study a few years ago and he found that 8 percent of all the wealth in the world is just being hidden away in tax havens like Panama, you know about the Panama Papers that’s revealed this, a huge amount of wealth that’s just not taxed at all, hidden away perfectly llegally in many cases, by the various laws. It seems to me that first we must stop the tax havens which are taking place internationally. Secondly, we must look at the concentration of capital in the big corporations. A Swiss institute did a survey which found 147 companies, just 147, control 70 percent of all the corporate wealth in the world. And if we had some sort of control over how they generate that wealth and how they distribute it by controlling them, then we’d be in a much better position to reorganize the inequality of wealth.

Just looking at trying to reduce the amount of income that the top 1 percent has I don’t think it’s going to be sufficient. And the OECD agrees with that.

SHARMINI PERIES: All right. Robert, then if the IMF and the World Bank and the OECD and the European Central Bank, ECB, they’re very effective at demanding and forcing nation states into implementing austerity measures, for example. So in effect, if these institutions took the position that there must be better distribution of wealth in a country, those policies need to be put in place, inequality must be reduced, the gap must be closed, and so on. If they were to have policies of that nature they are quite capable of implementing them, aren’t they?

MICHAEL ROBERTS: They are perfectly capable of implementing them. It’s a question of political will and political action. As I said earlier, when most of the governments which are in power at the moment, administrations of the major economies where this will be necessary, governments have no such program. In fact, the opposite. They are supporting the policies and interests of capital rather than the interest of the 99 percent.

So here we have the OECD, a respected international economic agency which is supposedly providing advice and research about what should happen, and it’s telling the governments of, the major governments of the world, the inequality of wealth is way too high, much even worse than inequality of income, which is bad enough and getting worse, and something must be done about it, whether it’s taxing on wealth or whatever. And we have a bunch of governments, the major governments who represent, say, in the G20, all of whom virtually have no intention of doing anything about this. It reminds me, Sharmini, of the arguments about climate change. The science shows that the world is heating up. Global warming is getting out of hand. It’s going to damage the world’s natural resources and ruin people’s lives. But governments are not prepared to do anything serious about it.

So it’s down to political will and political action. And your viewers and readers and listeners should be aware that it’s really a question of political action, not some sort of impossible task that can’t be turned around.

SHARMINI PERIES: I’ve been speaking with Michael Roberts, the author of “The Great Recession” and “The Long Depression.” Michael, I thank you so much for joining us today.

MICHAEL ROBERTS: Thank you.

SHARMINI PERIES: And thank you for joining us here on the Real News Network.